24/04 – Weekly Fintech Recap

- 24.04.2023 09:00 am

11/11 – Weekly Fintech Recap

- 11.11.2022 06:00 pm

Equals Group Partners with Featurespace to Enhance...

- 22.08.2022 10:55 am

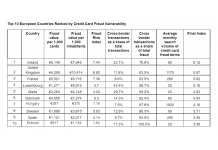

New Research Reveals Ireland is the Credit Card Fraud...

- 01.08.2022 09:50 am

18/07 – Weekly Fintech Recap

- 18.07.2022 09:00 am

Red Hat Releases Open Source StackRox to the Community

- 17.05.2022 01:25 pm

MSAB Part of New European Standard for Mobile Forensics

- 05.05.2022 09:20 am

Vyta Receives £11M Investment from MML and Acquires IT...

- 04.05.2022 11:10 am

MyComplianceOffice Announces Close of Schwab...

- 03.05.2022 01:00 pm

PSD2 and MFA - What Exactly Do They Mean?

- 08.02.2022 10:52 am

14/01 Weekly FinTech Recap – What’s the Hottest?

- 14.01.2022 08:00 am

DeFinity Partners with Leading Fintech Market...

- 22.12.2021 11:30 am