Particeep's Open Banking API is Open for Business

- Product Reviews

- 08.06.2018 11:21 am

A brief summary of the open banking API

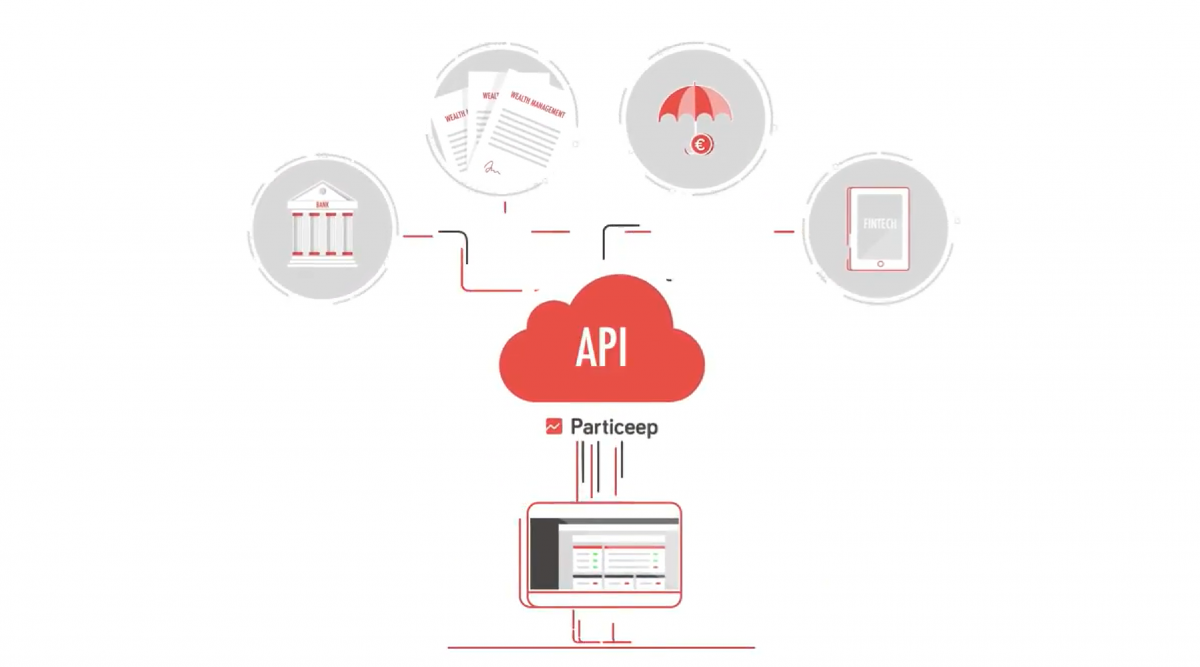

Particeep designs its solutions in order to remove any technological barrier for financial institutions wishing to distribute online their products and services.

Particeep offers banks an open banking API to make accessible through a single integration and securely their repository of products and services, pricing elements, partners offers to scale online their sales strategy. Their data and products are then easily available on any web/ mobile platforms.

The idea to launch an open banking API

Particeep's solution was initially available as a white label platform for FinTechs and asset management companies that offered online investment solutions; and was then deployed as an API for banks and insurances.

Several elements motivated the launch of this open banking API:

1- A change in the way banking services are consumed

Increasing demand for turnkey banking services that can be integrated into a simplified and mobile customer experience

Recent regulatory developments that require banks to make their data available to third parties and intensify their competitive environment

2- Banks are struggling to keep pace with the innovation race

Banks do not take advantage of the data they hold on their clients’ behaviours, which lowers their market shares.

Despite the creation of internal innovation centres, banks still face a problem of agility and velocity in the launch of new online products because of multitude of products and complexity of internal process.

The Open Banking API proposed by Particeep brings an answer to these two problems.

Besides, it allows the banks to:

- Collect from multiple sources, aggregate and take advantage of data in order offer tailor-made offers to customers

- Rapidly deploy online a range of financial and non-financial products and services that can be sold on bank and partner platforms

- Have in-house an agile cloud architecture that is flexible, affordable, compliant and simple to maintain

The primary function of the open banking API?

The Particeep Open Banking API provides templates for banking/insurance products that enable the bank to digitize its product repository to ease the distribution on any online financial services platform.

The distribution can be done by the bank itself or by any third parties no matter the existing technological infrastructure.

This main functionality is backed up by an API management layer that can be used to sequence key events such as customer data checkpoints or interfacing with third-party services and a brick of access control to products and data as part of third-party distribution.

Who needs this type of Open Banking API?

The main applicants for the Particeep open banking API are banks, insurers and financial services distributors (brokers).

The interest is simple:

- Exhibit their data, their products through APIs in order to monetize them by setting up customer-centric solutions that are internal or third parties related (partners, brokers)

- Enrich in a few weeks their online offer through APIs

- Transform as an interface in order to industrialize the distribution of products and those of the partners through an API to reach all vendors of financial products and services.

The main characteristics of the platform

The API platform has several features:

- Decoupling between the front-end (user interface) and back-end (financial products and services) to reuse the same code for different distribution channels

- Ready-to-use templates to sell common financial services such as opening an account, providing payment methods, credit, insurance and savings services

- A third party financial and non-financial API services hub integrated into the Particeep API and accessible on the simple configuration. For example e-signature, documents’ verification, accounts aggregation…

To which extent the API is user-friendly?

The API is accessible online, it is possible to test it in sandbox mode by creating, for example, a financial service and then simulating a client’s subscription. This makes it possible to test the technical reliability of our solution

Particeep provides a simple, interactive documentation with specific use cases as well as examples of codes allowing our API to be easily integrated no matter the technology used by our clients.

It applies a pricing model based on usage enabling our customers to innovate quickly and progressively increase their costs regarding their activity.

The available reporting capacities

The API provides its customers with a back office for data management.

It is endowed with logs systems and event management enabling to trace back all the data flow on the API. Also, the platform has integrated third-party data analysis services such as Mixpanel or Hotjar.

Finally, the API is integrated with Rest API, graphical language initially developed by Facebook to easily perform nested data queries and control results structure to simplify the development of custom reports.